Portfolio

I am an entry level data analyst with a background in sales operations and performance tracking. Through hands-on experience working with metrics, workflows, and data accuracy, I developed a strong interest in transforming raw data into clear, actionable insights. I am focusing on data exploratory analysis and visualization to uncover patterns that support better decision-making. With the use of AI and data analytics tools, i hope to help businesses achieve their business goal more efficiently.

Projects

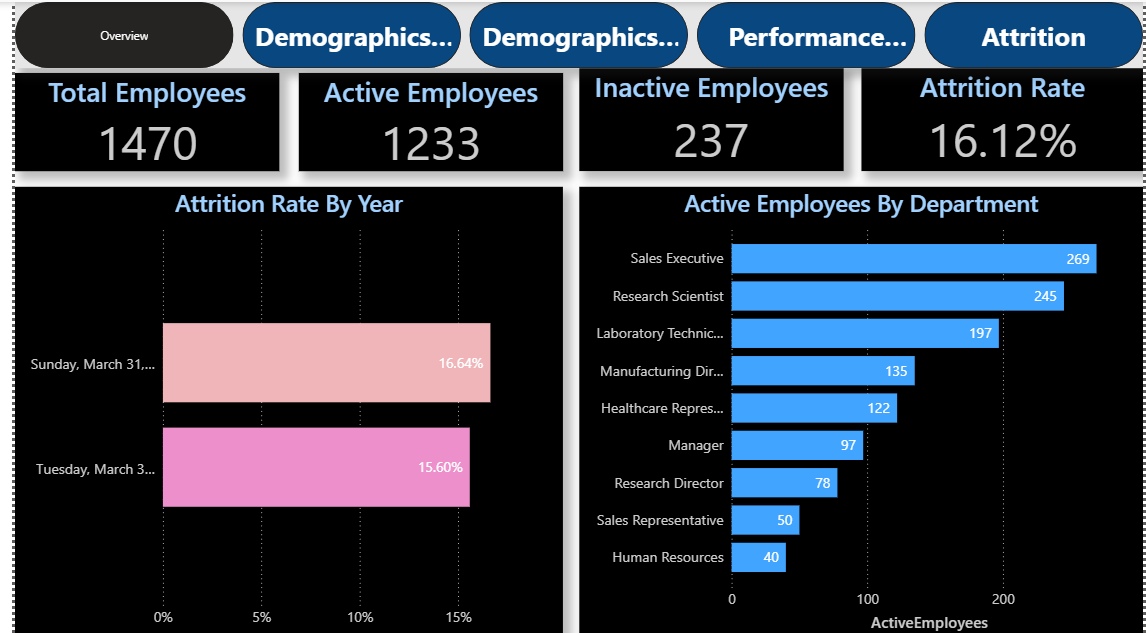

Data Modelling and Visualization

This project centers around HR analytics, specifically examining employee attrition and performance. By leveraging Power BI to create insightful data visualizations, the objective is to gain a deeper understanding of workforce trends and dynamics.

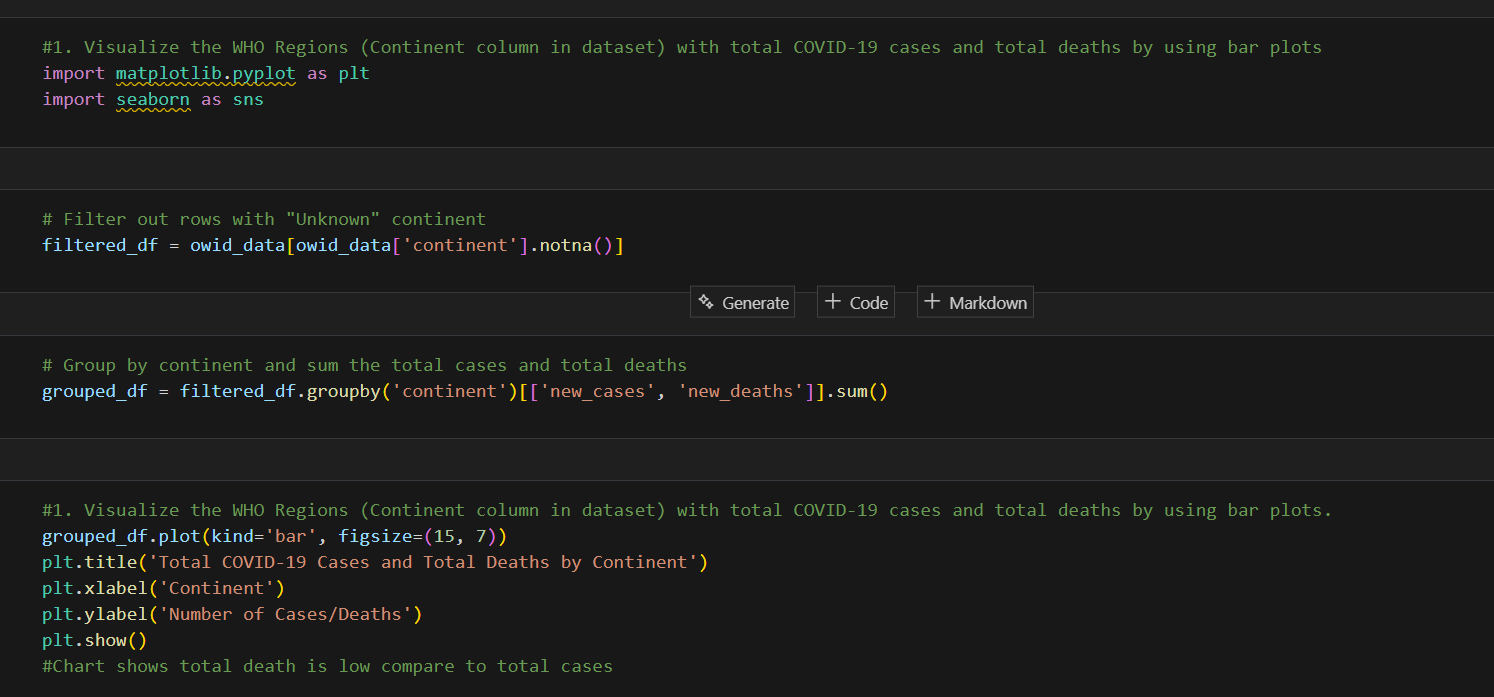

Python Visualisation

This project titled "Worldwide COVID-19 Data Analysis" is part of the WSQ – Python for Data Science (SF) module in the Professional Diploma in Data Science (PDDS-PYD) course. It serves as a summative assessment and focuses on analyzing and visualizing COVID-19 data using Python.

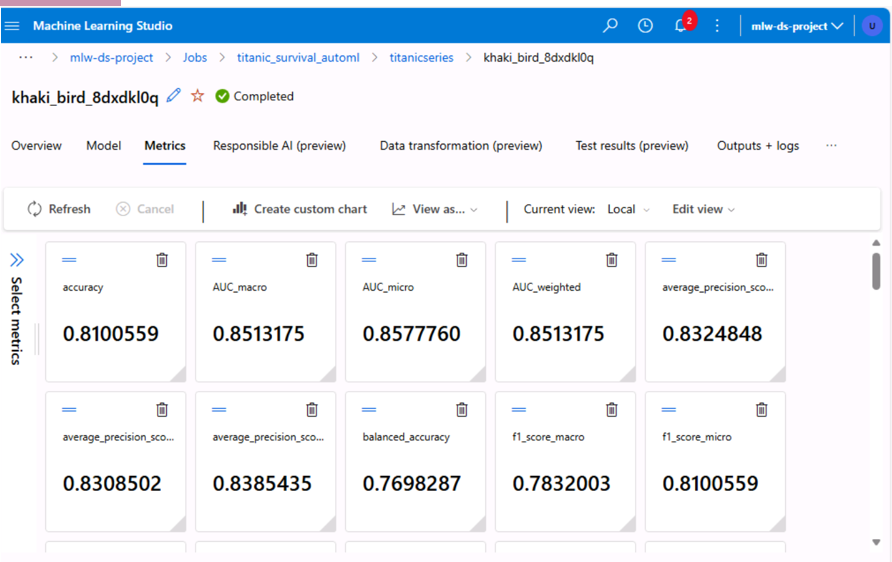

Azure model Creation 1

This project is designed to give learners practical experience in building and managing data science workflows using Microsoft Azure. The purpose is to help learners understand the full lifecycle of data handling, from secure storage to automated model creation and evaluation.

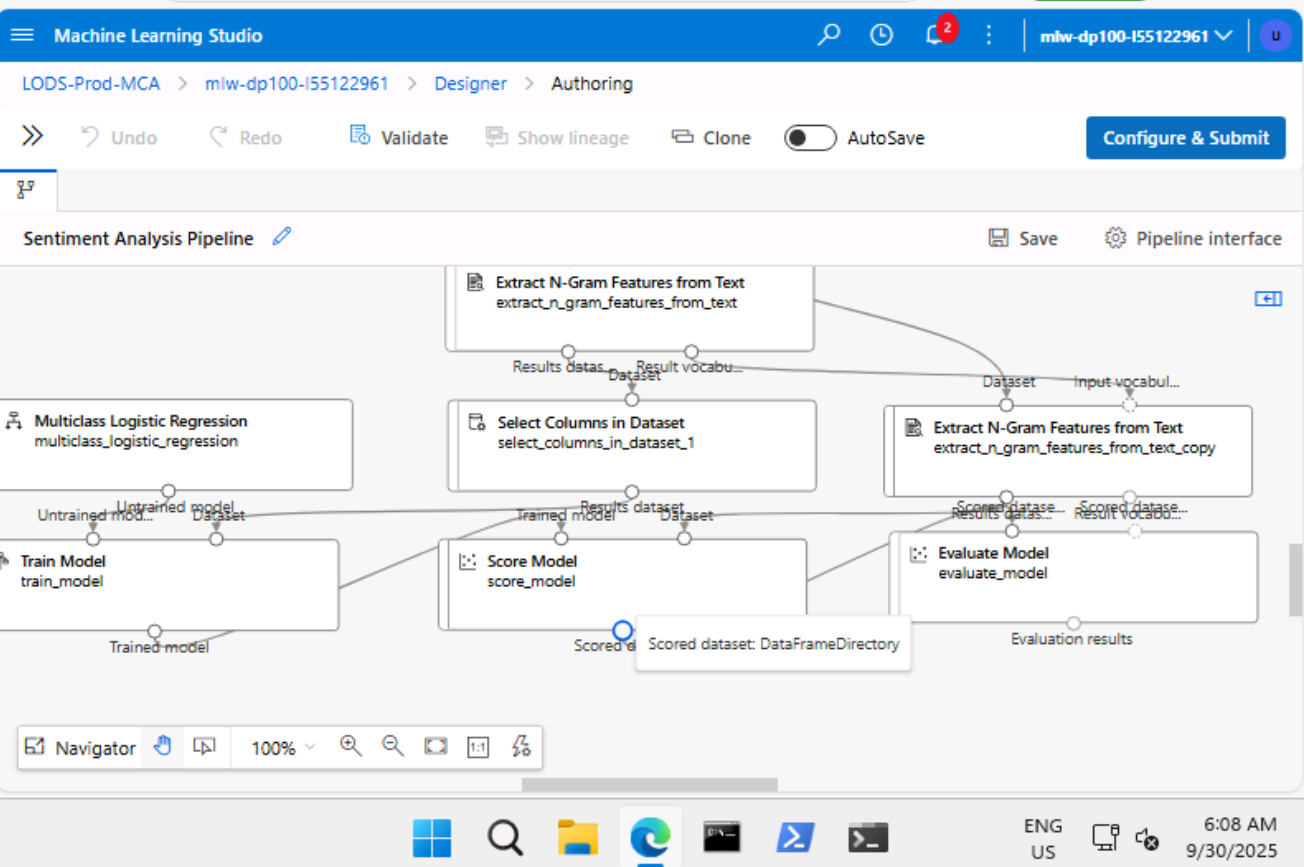

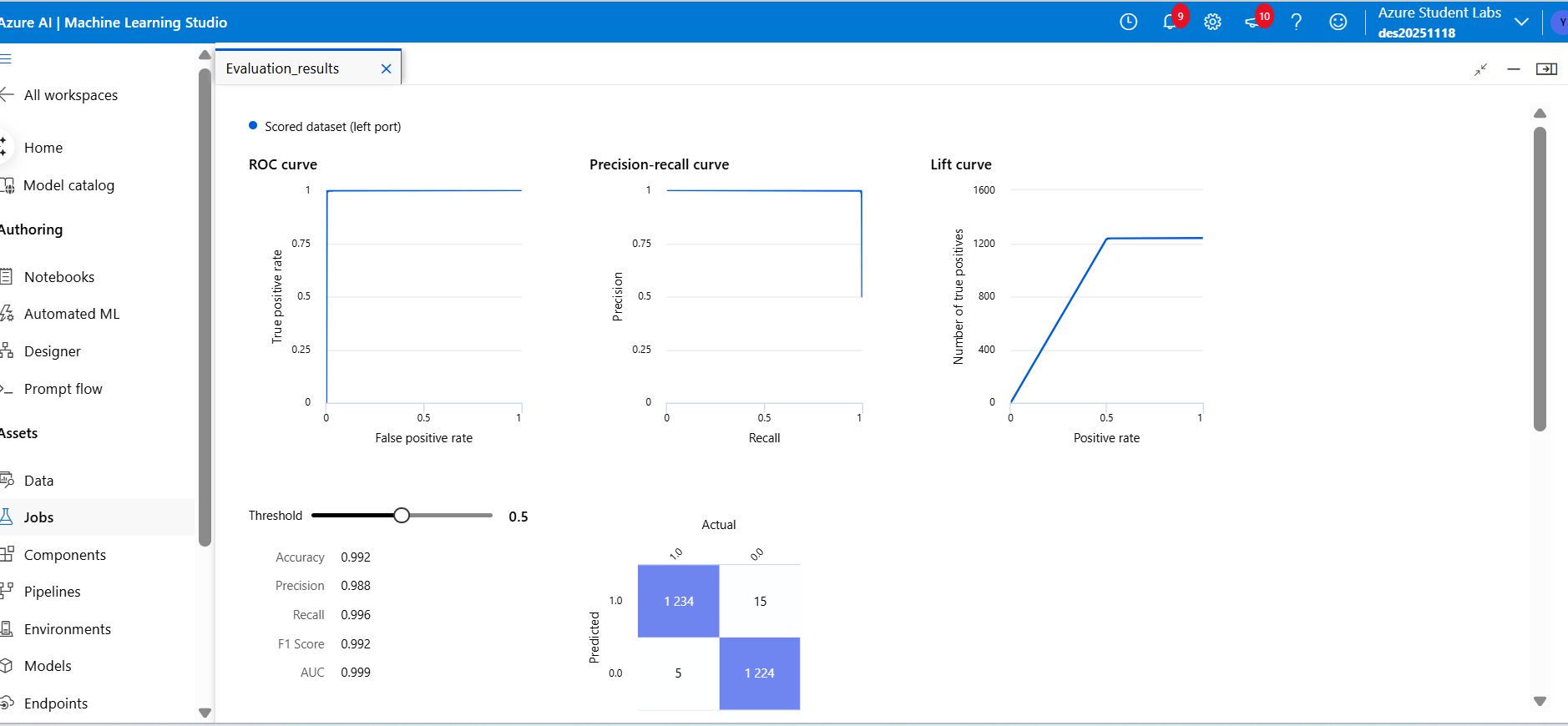

Azure model Creation 2

This project is on Machine Learning Algorithms and Methods. Its purpose is to give hands-on experience with Azure Machine Learning for real-world tasks. The work covers classification, regression, clustering, and sentiment analysis on structured and text data.

Azure AI Vision

This project focuses on applying Azure AI services to solve real-world business challenges for ABC Automobile Support Co. It involves four AI-based activities: image analysis, image classification, text sentiment analysis, and video analysis.

ABC Bank Simulation

This project simulates a real-world scenario where ABC Bank faces growing operational, security, and customer experience challenges. As the financial landscape evolves, customers expect faster loan approvals, personalized services, and immediate responses to inquiries, while fraud attempts and digital threats become increasingly sophisticated.

To keep pace, the bank is exploring how Artificial Intelligence (AI) and Machine Learning (ML) can strengthen its core operations. Students are tasked to act as data science practitioners applying AI solutions to real banking problems, including fraud detection, loan approval automation, customer segmentation, image and face analysis for security, OCR for document processing, and text analytics for customer communication.